massachusetts estate tax rates table

Example - 5500000 Taxable Estate - Tax Calc. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed.

Massachusetts Estate Tax Everything You Need To Know Smartasset

In the second column youll see the base taxes owed on wealth that falls below your bracket.

. The table below lists all of the rates. For the most up to date tax rates please visit the Commonwealth of Massachusetts. The maximum credit for state death taxes is 64400 38800 plus 25600.

In this example 400000 is in excess of 1040000 1440000 less 1040000. Updated February 22 2022. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Up to 100 - annual filing. Any gains when you sell inherited investments or property are generally taxable but you can usually also claim losses on these sales. If youre responsible for the estate of someone who has died you may need to file an estate tax return.

A properly crafted estate plan may. 402800 55200 5500000-504000046000012 Tax of 458000 Thoughtful estate planning is very important especially for those that wish to leave assets to their beneficiaries or heirs without being impacted by significant taxes. Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. 2021 federal capital gains tax rates. For example a single.

The credit on 400000 is 25600 400000 064. Compare these rates to the current federal rate of 40 Deadlines for Filing the Massachusetts Estate Tax Return. Massachusetts Estate Tax Rate.

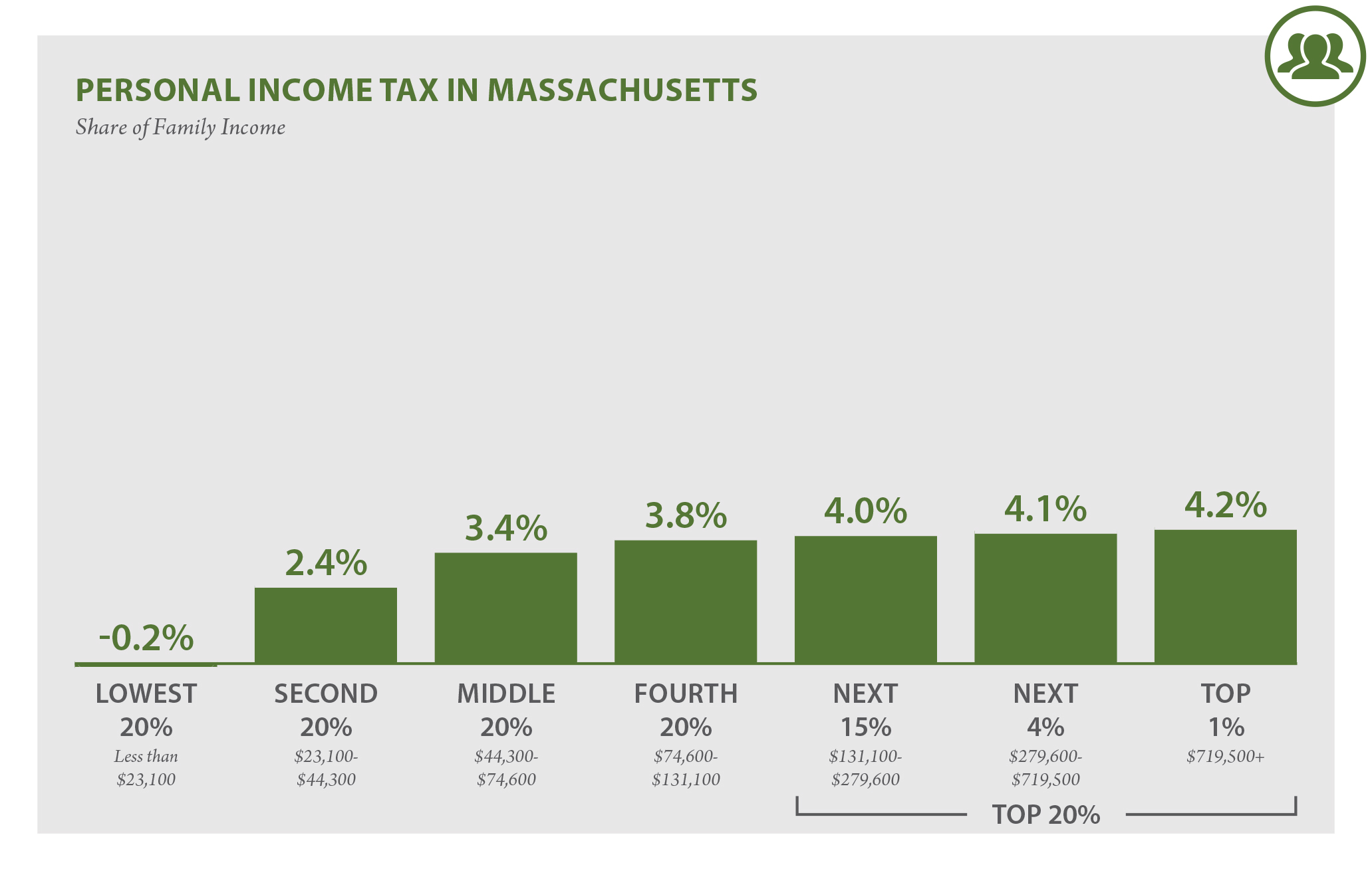

For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income. This means that different portions of your taxable income may be taxed at different rates. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16.

Take note that there are Massachusetts estate tax rates on estates valued below 1000000 down to 40000. If youre wondering what. 17 rows Tax year 2022 Withholding.

If you are planning on refinancing or getting a home loan in Massachusetts take a look at our Massachusetts mortgage rates guide. The towns in Worcester County MA with the highest 2022 property tax rates are Bolton 1987 Lancaster 1945 and Sturbridge 1915. 352 rows Property tax rates are also referred to as property mill rates.

The rate for residential and commercial property is based on the dollar amount per every 1000 in assessed value. The three Worcester County towns with the lowest property taxes are Dudley 1170 Royalston 1221 and Oakham 1272. The Massachusetts estate tax is equal to the amount of the maximum credit for state death taxes.

Ad From Fisher Investments 40 years managing money and helping thousands of families. An estate valued at 1 million will pay about 36500. 5000000 - 60000 4940000.

Below we have posted some of the marginal tax rates and tax liabilities associated with the values of progressively larger estates. The estate tax rate for Massachusetts is graduated. What are the estate tax rates in Massachusetts.

A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. 2020 Massachusetts Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. And so lets look at an excerpt from the Massachusetts estate tax table.

COVID-19 Vaccine Paid Family and Medical Leave in Massachusetts Jury Duty Apply for unemployment benefits Governor Updates Passenger Class D Drivers Licenses SNAP benefits formerly food stamps Personal Income Tax STEM Education. Massachusetts has its own estate tax which applies to any estate above the exclusion. The state sales tax rate in massachusetts is 625 but you can customize this table as.

The tables below show marginal tax rates. Your estate will only attract the 0 tax rate if its valued at 40000 and below. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16.

The states average effective property tax rate taxes paid as a percentage of market value is 117. 50 personal income tax rate for tax year 2021. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

Everything You Need to Know SmartAsset The Massachusetts estate tax rates range from 0 16 and apply to estates valued over 1 million. The average residential property tax rate for Worcester County is 1584. The top estate tax rate is 16 percent exemption threshold.

To figure out how much your estate will need to pay in estate taxes first find your taxable estate bracket in the chart below. Everyone whose Massachusetts gross income is 8000 or more must file a Massachusetts personal. Additionally because the taxable estate of 5000000 exceeds 1000000 the estate tax due is 391600.

If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would be 16that is you would not be taxed more than 16. Using the table this tax is calculated as follows. Massachusetts Estate Tax Rates Highlighted Section.

Certain capital gains are taxed at 12.

2022 Tax Inflation Adjustments Released By Irs

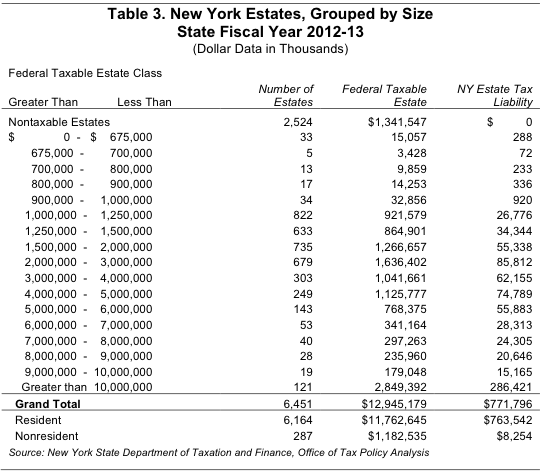

New York S Death Tax The Case For Killing It Empire Center For Public Policy

How Do State Estate And Inheritance Taxes Work Tax Policy Center

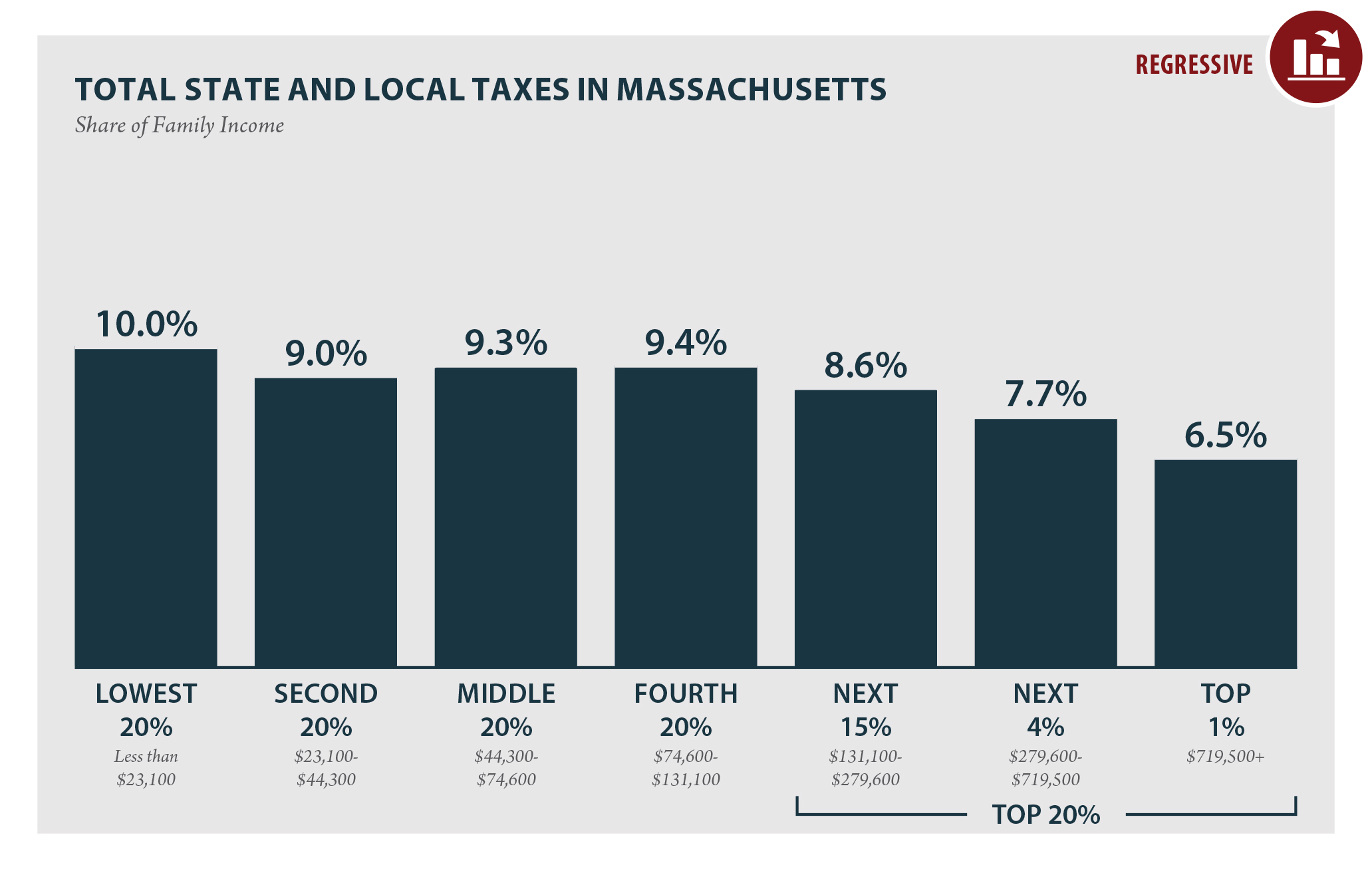

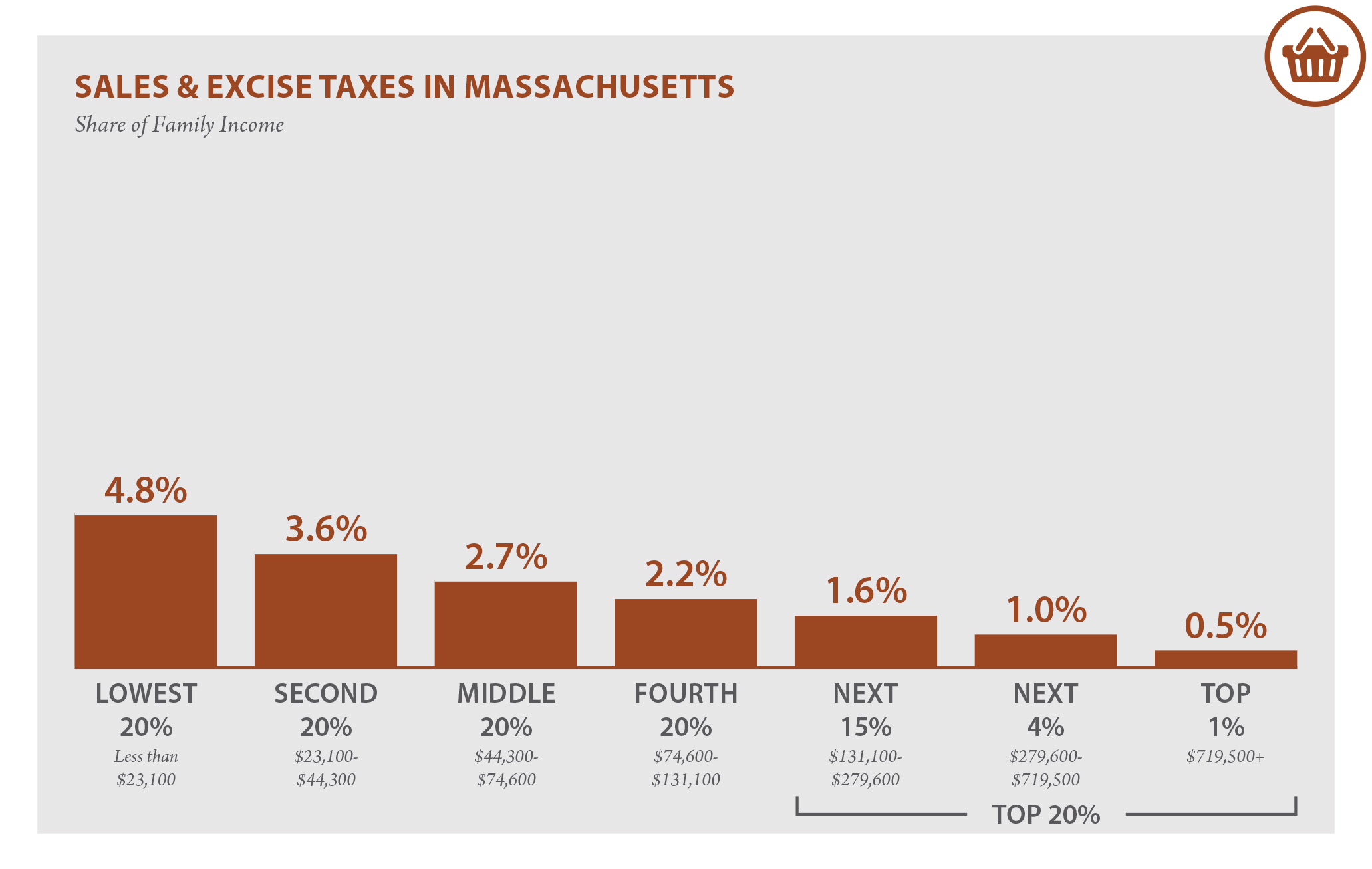

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset

New York S Death Tax The Case For Killing It Empire Center For Public Policy

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

A Guide To Estate Taxes Mass Gov

Massachusetts Estate Tax Everything You Need To Know Smartasset

How Do State And Local Sales Taxes Work Tax Policy Center

Massachusetts Who Pays 6th Edition Itep

Massachusetts Who Pays 6th Edition Itep

Massachusetts Who Pays 6th Edition Itep

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

How Do State And Local Corporate Income Taxes Work Tax Policy Center